Savings Rates during Q1 2021

March 2021

By Anthony Tunmore

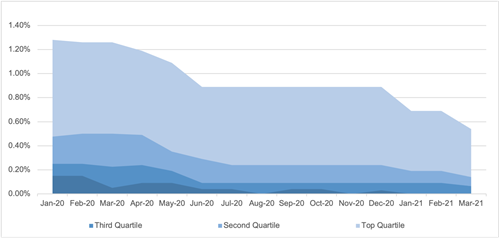

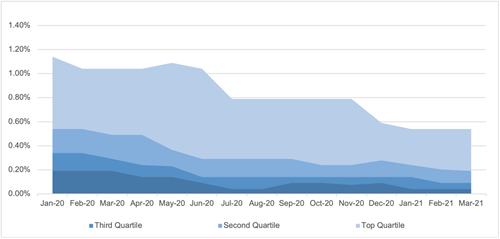

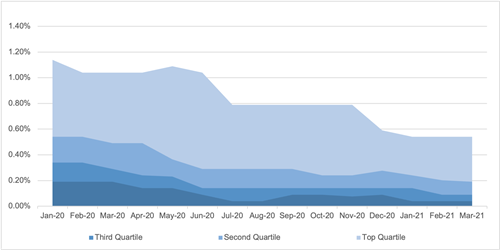

Savings rates in the first quarter of 2021 have remained very similar to those seen in the final quarter of 2020. The emergency base rate cuts in March 2020 continue to weigh heavy on savings rates, and this is expected to continue throughout the year ahead with a plateau expected as the market recovers from the coronavirus pandemic.

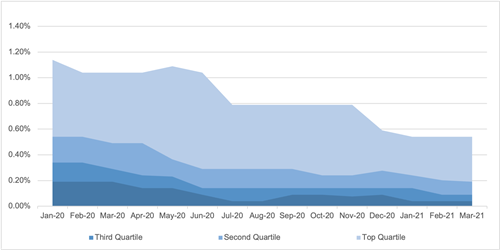

Personal Savings Rates

On Instant Access, Personal savers have a choice of 258 instant access products at the moment. Of these products, 93 have eligibility criteria attached to them, such as needing to be an existing customer of the provider or needing to live in a certain post code bracket to be eligible to apply. A further 49 are opened in person via in branch or by the telephone. This leaves an opportunity set of 116 instant access savings products for our clients.

Including all products, the best savings rate on Instant Access is offered today by Newbury Building Society paying 1.10%. This is payable on deposits up to £1.5m on a sole basis and is available for existing Newbury members. When we clean the dataset for products that can be opened online or in the post with no eligibility criteria, then the best rate available is with Yorkshire Bank and Yorkshire Building Society, each paying 0.50%. This rate is offered for deposits greater than £100,000 with Yorkshire Bank and is offered for deposits between £100 and £2m with Yorkshire Building Society.

Looking at notice products, Personal savers tend to prefer 90 to 95 day notice products within the service. Often our clients have exited from businesses where their wealth has been illiquid for quite some time. 90 to 95 day notice products are popular in this scenario where there is a healthy balance of return versus liquidity. Up to 95 day notice terms, Personal savers have the choice from 342 products, including Instant Access products. Making the same exclusions, new savers have an option from 145 products. Within this space, the best rate on offer is from OakNorth Bank presently paying 0.56% on their 90 day notice deposit account. This account is available for Personal savers wishing to invest between £1 and £500,000 (or £1m if held jointly).

While instant access and notice products are useful for many clients, rates are volatile at the moment and these types of products have variable rates that may change. Some clients that have known liquidity needs longer than one year away or those who don’t have any immediate need for cash prefer to use fixed term products as the rate on these products is typically fixed for the fixed term period. In the fixed term market, there are presently 384 fixed term products available, of which 232 are open to new customers and can be opened either online or via the post. The best rate in the fixed term market for new customers is available from Hodge Bank via an online exclusive over a 5 year period paying 1.30% per annum on deposits between £1,000 and £1m. In the shorter fixed term market, the best 1 year product rate is 0.65% and this is payable from 1 year products offered by Ahli United Bank (UK), Habib Bank Zurich, SG Kleinwort Hambros and QIB UK.

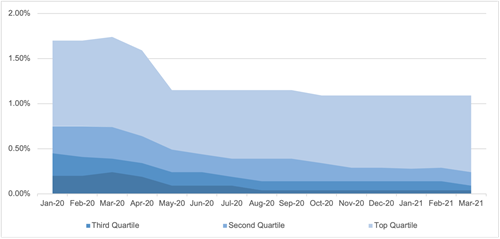

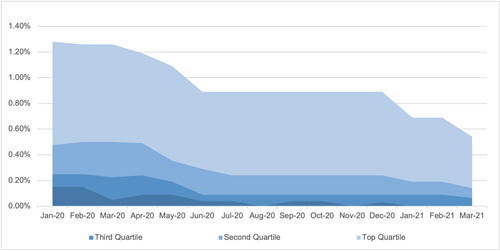

Corporate Savings Rates

On Instant Access, Corporate savers have a choice of 76 instant access products at the moment. Of these products, 36 have eligibility criteria attached to the or require attendance in branch or by phone for account opening. This leaves an opportunity set of 40 instant access savings products for our clients.

Including all products, the best savings rate on Instant Access is offered today by Hanley Economic Building Society paying 0.55%. This is payable on deposits between £1,000 and £250,000. This product is followed by 4 products paying 0.50% on offer with Monmouthshire Building Society, Penrith Building Society, Aldermore Bank and Shawbrook Bank.

Looking at notice products, Corporate savers within the service tend to prefer notice products up to 120 days. Up to 120 day notice terms, Corporate savers have the choice from 217 products, including Instant Access products. Making the same exclusions as for Personal savers, new corporate savers have an option from 94 products. Within this space, the best rate on offer is from Hodge Bank presently paying 0.70% on their 100 day notice business deposit account. This account is available for corporate savers wishing to deposit between £1,000 and £1m.

Some corporate clients will keep cash for known liquidity needs in instant access and notice accounts. Any surplus will typically be placed into fixed term as the rate on these products is typically fixed for the fixed term period and often higher than the rate available on flexible access or variable rate products. In the fixed term market, there are presently 143 fixed term products available, of which 73 are open to new customers and can be opened either online or via the post. The best rate in the fixed term market for new customers is available from Cambridge & Counties Bank via an online exclusive over a 5 year period paying 1.15% per annum on deposits between £10,000 and £5m. In the shorter fixed term market, the best 1 year product rate is 0.75% and this is payable from 1 year products offered by Masthaven Bank. Shawbrook Bank and Hodge Bank.

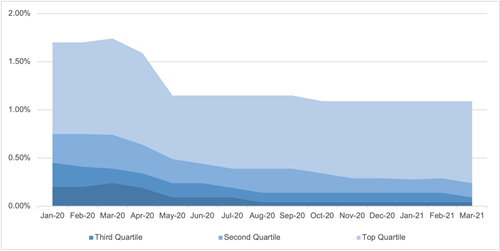

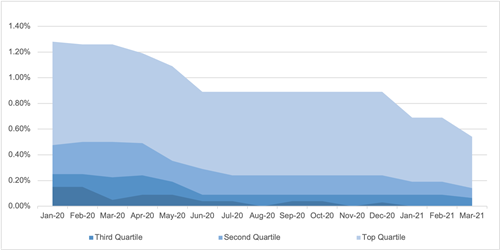

Charitable Savings Rates

Our charitable clients have been hit hard over the pandemic. Needs for their services have risen while donations from fundraising activities have been challenged with postponement of events such as the Great North Run and the London Marathon, amongst many others. Making sure charities get every penny they can for cash held is of paramount importance. For example, an extra £1,000 interest for Mountain Rescue can fill 100 Entonox cylinders to help relieve pain for an injured casualty, while the same amount for Age UK could pay for 66 visits to an older person in need of company from a trained and checked befriender. Every little penny really does make a difference in this regard, and we are passionate about helping to ensure charities get as much support as possible.

On Instant Access, Charitable savers have a choice of 54 instant access products at the moment. Of these products, 23 have eligibility criteria attached to the or require attendance in branch or by phone for account opening. This leaves an opportunity set of 31 instant access savings products for our clients.

Including all products, the best savings rate on Instant Access is offered today by Hanley Economic Building Society paying 0.55%. This is payable on deposits between £1,000 and £250,000. This product is followed by further instant access accounts on offer from the same provider at 0.35%, matched too by Monmouthshire Building Society.

Looking at notice products, Charitable savers within the service tend to prefer notice products up to 120 days. Up to 120 day notice terms, Charitable savers have the choice from 119 products, including Instant Access products. Making the same exclusions as mentioned above for Personal savers, new charitable savers have an option from 67 products. Within this space, the best rate on offer is from Redwood Bank presently paying 0.70% on their 95 day notice business savings account. This account is available for incorporated charities wishing to deposit between £10,000 and £1m.

Charities will keep cash for known liquidity needs in instant access and notice accounts, with a healthy buffer for the unexpected. Any surplus will typically be placed into fixed term as the rate on these products is typically fixed for the fixed term period and often higher than the rate available on flexible access or variable rate products. In the fixed term market, there are presently 72 fixed term products available, of which 44 are open to new customers and can be opened either online or via the post. The best rate in the fixed term market for new customers is available from Cambridge & Counties Bank via an online exclusive over a 5 year period paying 1.15% per annum on deposits between £10,000 and £5m. In the shorter fixed term market, the best 1 year product rate is 0.70% and this is payable for incorporated charities offered by Hampshire Trust Bank. For non-incorporated charities, United Trust Bank are presently paying 0.60% on their 1 year fixed term product.