Savings rates stabilise as the market prepares for Covid-19 Vaccination launch

October 2020

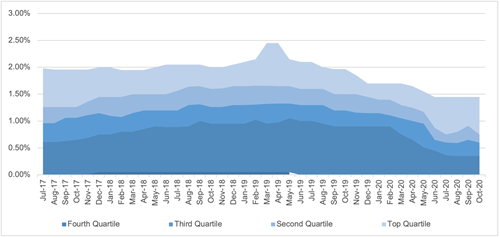

Over the last three months, savings rates have continued to be suppressed by the economic impact of the global Covid-19 pandemic. There has been a stabilisation of rates in the top quartile for most client types with the biggest reductions made during the summer months of this year. Negative interest rates unfortunately remain a possibility but with an imminent vaccination programme expected, we hope that the rates will stabilise at their current level for the coming months.

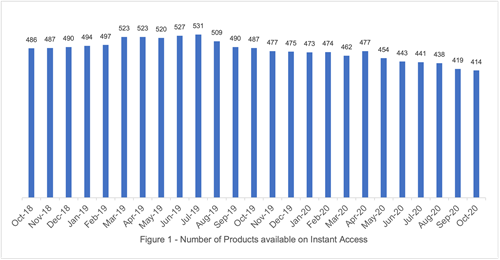

In completing our detailed analysis, we noticed that the volume of products in the market has decreasing over time. Considering the choice available for Instant Access savers as an example, there has been a significant decline since a peak in the summer of 2019 from 531 products available in July 2019 to 414 as of October 2020. A decline in choice precedes a reduction in competition, which in turn has typically led to a reduction in rates. This holds in our analysis across all notice period terms aside from 45 day notice products that are typically offered by the same providers year-on-year. Rates for Instant Access savers over the same period have fallen by nearly 40% in the top quartile and by nearly 60% on average during that same timeframe.

This change can be traced back to a change in the leadership of the UK government from Theresa May to Boris Johnson, at which point the market began to price in more clearly the expectations of the Brexit negotiations. Between July 2019 and March 2020, rates on Instant Access and up to 90 day notice periods had fallen on average by 6% with declines of 20% on average for fixed term periods between 1 and 5 years. Since March 2020 however rates have nearly halved on some product terms, particularly on notice period accounts. The double impact therefore of both Brexit and Covid-19 is clear.

In a declining interest rate environment, the important consideration is the relative performance of the cash compared to being held in a current account or indeed in the convenience of savings account with one of the Big 4 banking providers. It is common knowledge now that most current accounts are today paying 0.00% on any cash held and most capital held across any term held in savings in the Big 4 banks is earning very little irrespective of the term.

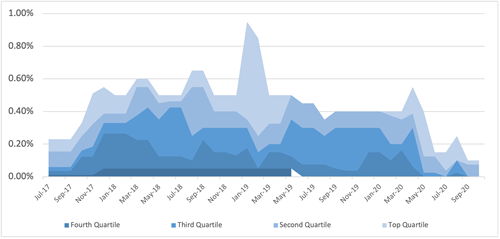

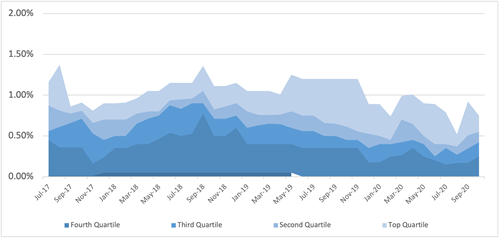

If we consider the one year fixed term bond market in Figures 3, 4 and 5 we can see the decline of rates by institution type. Rates for the Big 4 on a one year term have fallen to 0.30% at the top of the market for savers. In comparison, Challenger Banks and Building Societies have reduced their rates but have done so to a lower extent than those seen at the Big 4.

Rates today are reaching 1.06% on a 1 year fixed term for savers at the Challenger Banks and 0.90% for savers at Building Societies. These rates, while still lower than they have even recently been over the last few years, are higher relatively speaking today when compared like for like. We feel moving forward that opportunities will lie principally in the Challenger Bank space for savers as we navigate the prolonged economic impact of Covid19 and a following recovery.

With the exit of the UK from the European Union, policymakers are acquiring greater autonomy and stronger domestic regulatory powers, and many are suggesting there will be a big push for new providers to enter the market to increase the opportunity for savers by increasing the competition for cash. There have been a few new providers enter the market of late and we cover them in more detail herein. We’ll be sure to keep you updated as and when new providers launch to ensure you remain on the very best rates for your cash.